Our Approach to Sustainability

Top Message

With maximizing unitholder value as its ultimate objective and growth, stability, and transparency as its basic policies, TOKYU REIT aims to enhance asset value and grow profits over the medium- to long-term through “investment in highly competitive properties in areas with strong growth potential.” Moreover, since TOKYU REIT was listed in 2003, its basic investment management strategy has been the “Capital Reinvestment Model,” which aims for constant value enhancement of the portfolio and investment target areas through collaboration with the sponsor.

From the time it was founded, the sponsor Tokyu Corporation has pursued sustainable urban development with the aim of balancing profitability and public duty—in other words, balancing business growth with the resolution of social issues—over a period of 100 years, with the development of public transportation and residential areas along Tokyu railway lines as its two pillars. TOKYU REIT will achieve medium- to long-term enhanced portfolio asset value and profit growth by aiming for constant value enhancement through collaboration with the sponsor aligned with the real estate life cycle in investment target areas, including areas along Tokyu railway lines that are also targeted by the sponsor.

Furthermore, along with the Long-Term Investment Management Strategy (Surf Plan), which focuses on the cyclical nature of real estate prices in the medium- to long-term, TOKYU REIT engages in sustainable investment management that emphasizes growth and stability, with the aim of being a ”100-year REIT” (i.e., a REIT that will keep growing for 100 years).

In order to pursue sustainable investment management, TOKYU REIT and Tokyu REIM view ESG and the SDGs (Sustainable Development Goals) as key management issues. Based on the Sustainability Policy created by Tokyu REIM in March 2022, they are promoting initiatives in various ESG fields.

From an environmental perspective, based on the awareness that climate change is a key issue that will have a major impact on business activities, Tokyu REIM conducted a scenario analysis based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), disclosing the results in March 2023. Moreover, for the purpose of increasing the effectiveness of its environmentally friendly initiatives, it has set the following targets: reducing greenhouse gas emissions by 46.2% vs. FY2019 (on an intensity basis) by FY2030 and becoming carbon neutral by FY2050 and achieving an environmental certification acquisition rate of 70% or more (based on total floor space) for owned properties by FY2025. While energy-saving initiatives are associated with costs in the short-term, TOKYU REIT views them as up-front investments that will increase opportunities by decreasing existing costs and enhancing asset value in the medium- to long-term and aims to achieve its targets.

From a social perspective, Tokyu REIM has shared the Sustainable Supply Chain Policy created by the sponsor Tokyu Corporation, strives to monitor sustainability-related issues throughout the entire supply chain regarding its business, and pursues contributions to the formation of a sustainable society in collaboration with various stakeholders, including tenants, local communities, and suppliers.

Tokyu REIM is also striving to develop a work environment where each employee can make full use of their skills while feeling passionate about their work.

In terms of governance, TOKYU REIT views exceptional governance as a source of competitive advantage that will help enhance unitholder value, and in the 20 years since its founding, it has always striven to develop a top-class governance approach and to protect investors and enhance unitholder value through rigorous management.

Going forward, TOKYU REIT and Tokyu REIM aim to enhance portfolio value and maximize unitholder value through building positive relationships based on dialogue with stakeholders and helping to enhance the value of investment target areas, while also pursuing contributions aimed at realizing a sustainable society. Your continued support is greatly appreciated.

December 2023

Yoshitaka Kimura

Executive Director

TOKYU REIT, Inc.

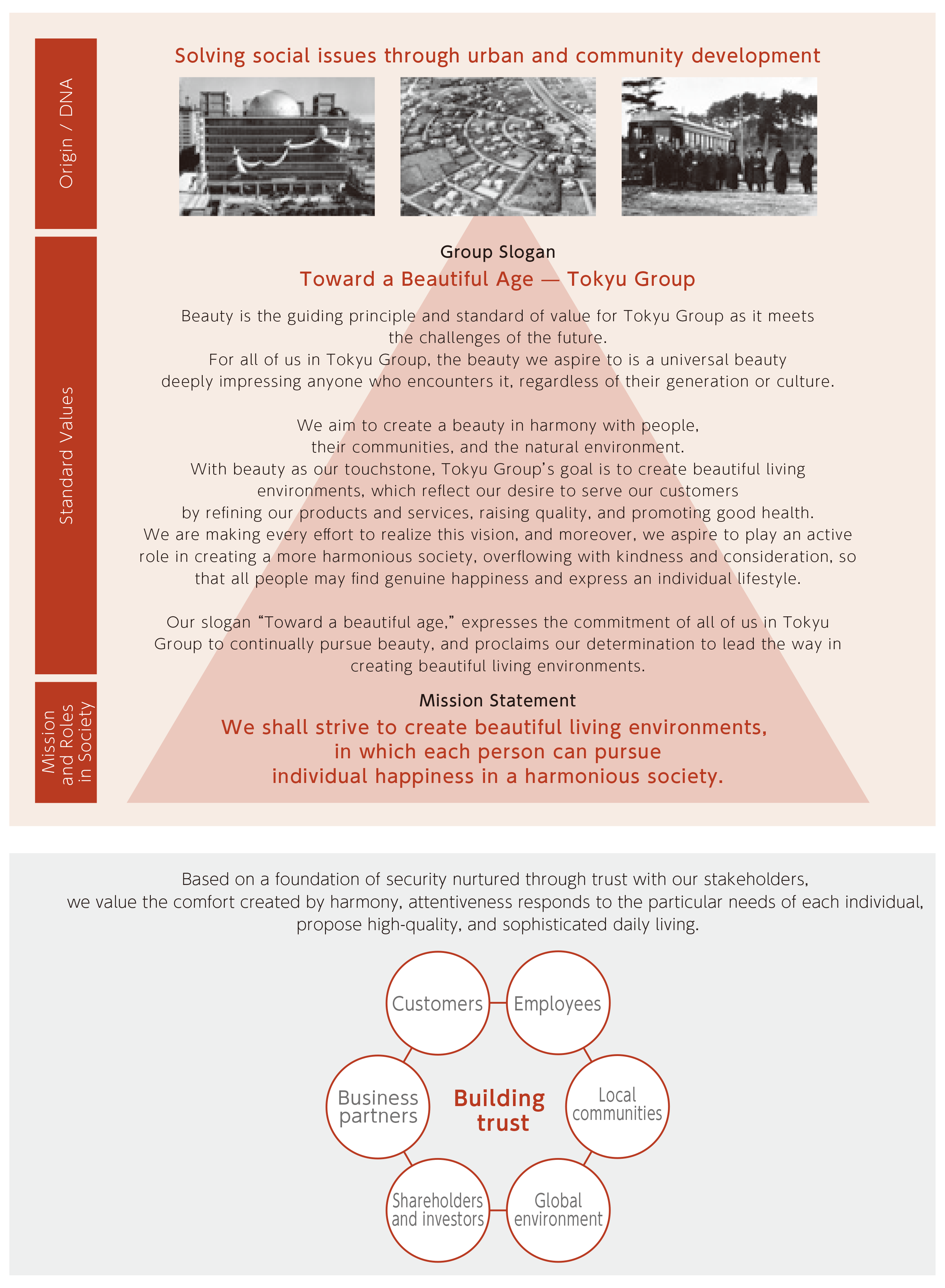

What Tokyu Group Aim For

The Tokyu Group has positioned urban development underpinned by transportation services as the cornerstone of its business and provides high-quality, cosmopolitan lifestyle value through services in various fields closely linked to people’s lives.

With the aim of “creating beautiful living environments,” it pursues a “harmonious society” and “individual happiness” while building trusting relationships with stakeholders.