Basic Policies

Basic Policies

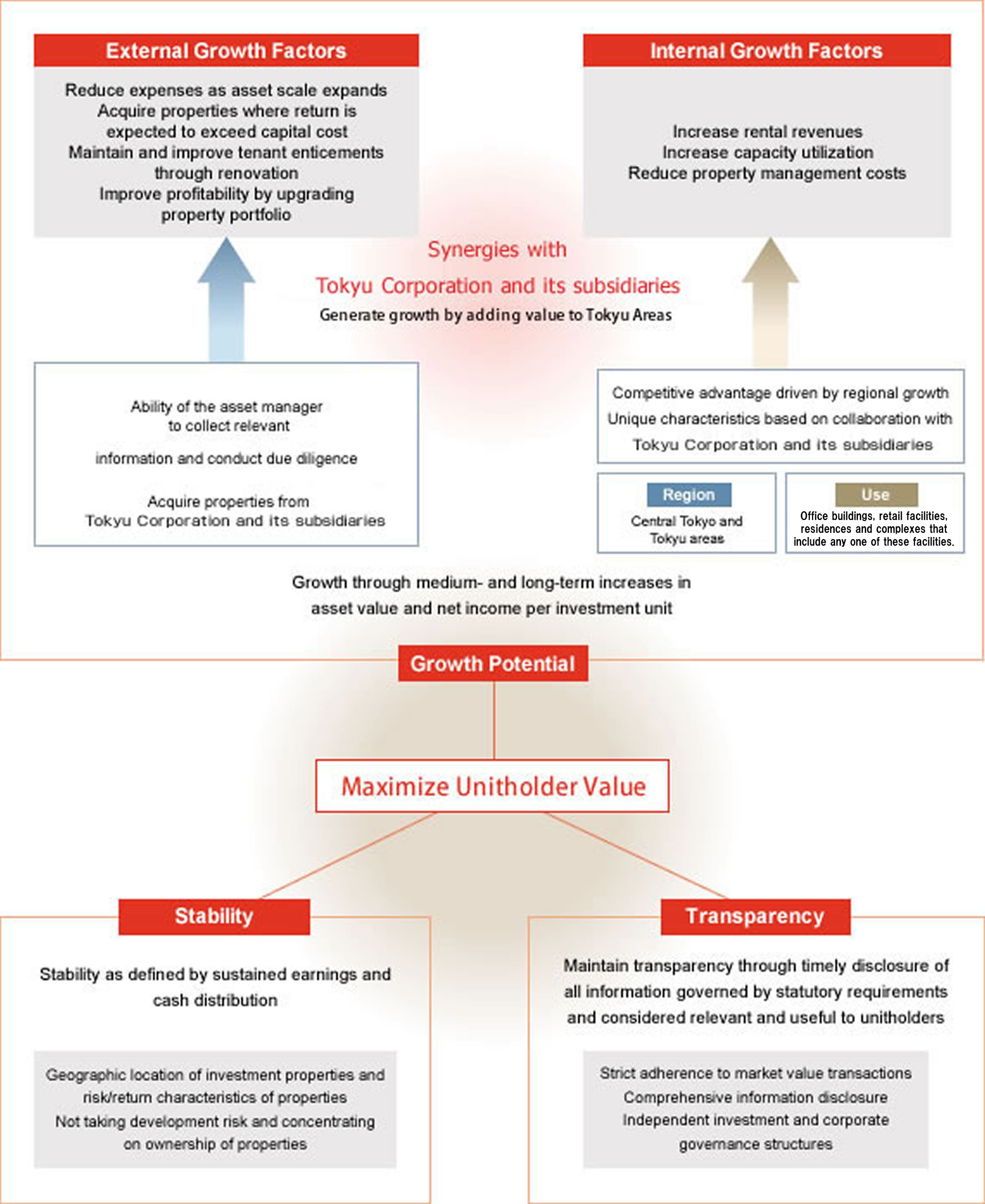

TOKYU REIT invests primarily in office buildings, retail facilities, residences and complexes that include any one of these facilities located in Tokyo’s central five wards (Chiyoda, Chuo, Minato, Shinjuku and Shibuya wards) and the Tokyu Areas, which refers to the areas serviced by the Tokyu rail network.

TOKYU REIT focuses on office buildings, retail facilities, residences and complexes that include any one of these facilities, especially in Central Tokyo and the Tokyu Areas.

Growth potential shall be secured through the achievement of both enhancement of asset values from a medium- to long-term perspective and growth of net income per investment unit from an internal and external growth perspective.

(1) Internal growth factors

Optimization of asset management

In order to achieve internal growth, TOKYU REIT shall outsource management which aims to optimize portfolio value from a medium- to long-term perspective to an asset management company.

The asset management company shall select a property management (hereafter "PM") company suitable for each property and shall instruct and supervise the said PM company. Furthermore, based primarily on the following objectives, it shall strive to maximize the cash flow of each property.

- By establishing trust relationships with tenants and through tenant marketing, it shall strive to enhance tenant satisfaction and make it its goal to maintain and improve rents and occupancy rates

- Through efficient management and operations, it shall strive to reduce property management costs, etc.

Growth based on the area where the investment target is located and its type of use

The investment targets of TOKYU REIT are primarily office buildings, retail facilities, residences and complexes that include any one of these facilities located in the Tokyo central 5 wards and areas along the Tokyu rail lines ("Tokyu Areas"). However, we shall not invest in areas other than the Tokyo Metropolitan Area(Investment target area). (Please refer to this page.)

TOKYU REIT shall make it its goal to realize internal growth based on the following characteristics of the abovementioned areas and uses.

- Relative superiority of the growth ability of the area itself

- Relative superiority of the economic sphere of the Tokyo Metropolitan Area centering the Tokyo central 5 wards area.

- Economic strength and brand ability of Tokyu Areas themselves

- Originality based on expectations of cooperation with Tokyu Corporation and its subsidiaries

- Expectations for strategic investment and business activities being operated by Tokyu Corporation and its subsidiaries primarily in Tokyu Areas.

- Superiority of Tokyu Corporation and its subsidiaries

- Tenant sales performance backed by an information network on tenants and local contacts

- By making Tokyu Corporation and its subsidiaries our PM companies in principle, their expertise in real estate management towards management properties outsourced from third parties other than from TOKYU REIT as well as their ability to reduce management and operations costs taking advantage of their economies of scale brought about through their conducting property management operations.

(2) External growth factors

Proactive property acquisition and maintenance and improvement of portfolio quality

TOKYU REIT shall proactively acquire office buildings, retail facilities, residences and complexes that include any one of these facilities located in the Tokyo central 5 wards area and Tokyu Areas, which are primary investment targets of TOKYU REIT, at reasonable prices, based on the original information collection ability and property assessment ability of the asset management company. When acquiring property, individual real estate shall be selected based on property assessments and on the assumption they will be held long-term. By replacing portfolio properties as needed, and through other acts, we shall strive to maintain and improve portfolio quality and shall make it our goals to enhance asset value and achieve growth of net income per investment unit.

Property acquisition from Tokyu Corporation and its subsidiaries

TOKYU REIT shall secure acquisition opportunities for stable and continuous properties out of properties owned by Tokyu Corporation and its subsidiaries. To this end, a memorandum relating to the purchase and sale of real estate was concluded between Tokyu Corporation, TOKYU REIT and the asset management company.

Securing stability is the act of securing stable earnings and dividends (distributions) primarily through the following.

Areas where investment targets are located and risk-return characteristics of properties

TOKYU REIT shall limit investment target areas to areas that are considered relatively low in risk. Based on this assumption, it shall make as its investment targets, properties which have relatively low fluctuations in rental income and occupancy rates and that are expected to generate stable profitability. Thereby, TOKYU REIT shall strive to carry out stable management. Although it is possible that certain properties may generate high capital gains, TOKYU REIT in principle does not intend to make properties with greater fluctuations in profitability its investment targets.

Aversion of development risk

TOKYU REIT, in principle, does not invest in properties that are under construction and not yet in operation. Development risks borne in the development business or as a developer shall be borne by Tokyu Corporation and its subsidiaries or other third parties. TOKYU REIT plans to secure opportunities to acquire properties after making sure that any development risks that may be borne are averted.

To secure transparency, TOKYU REIT intends to proactively and in a timely manner disclose to unitholders all material information to the extent TOKYU REIT deems the disclosure of such information useful and proper, aside from legal disclosures.

Furthermore, while keeping in mind that business and transaction opportunities may be brought about to Related Parties through investment activities in general, TOKYU REIT shall give due consideration to avoidance of conflicts of interests arising with related parties in individual businesses and transactions by abiding with the following.

- Thorough implementation of transactions at market price

- Enhancement of information disclosure

- Securing of an independent management structure and corporate governance structure

Specifically, Tokyu REIM shall formulate self-imposed rules known as Rules on Related-Party Transactions and shall amend them as needed. The company shall also disclose argument of them and comply with these. Furthermore, TOKYU REIT shall confirm the compatibility and appropriateness of individual transactions and ensure the workability of the related party transactions by implementing multiple checks. These checks include having deliberation by Compliance and Risk Management Committee and obtaining their approval from TOKYU REIT's board of directors prior to resolution of Tokyu REIM’s board of directors.

Please refer to this page, about Related-Party Transactions Rules and Double Checks for Due Process.