External Growth Policy

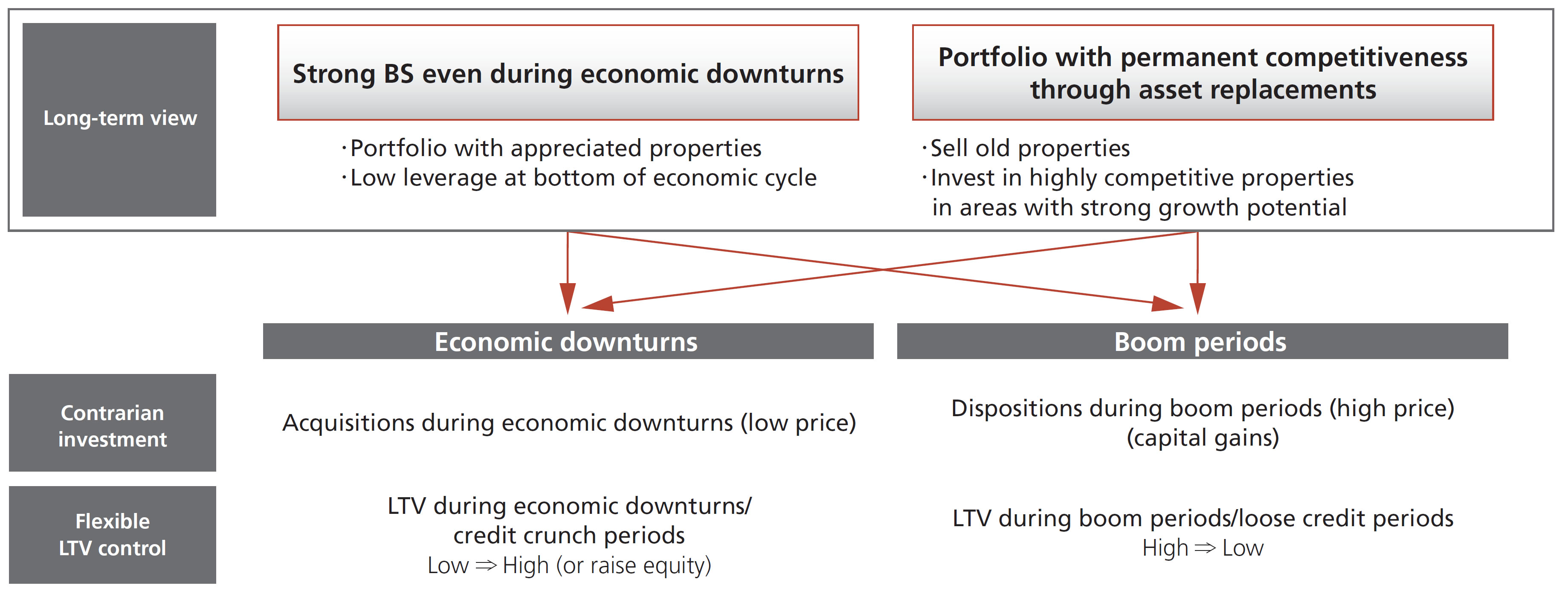

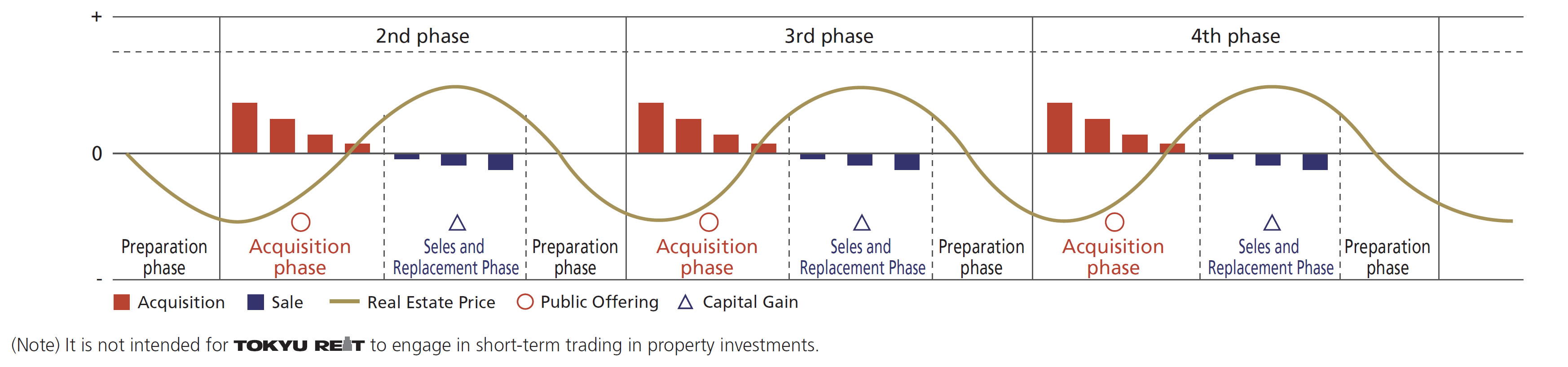

TOKYU REIT has conducted investment with a focus on the cyclicality of real estate prices, in order to achieve enhanced portfolio quality. Specifically, TOKYU REIT has been implementing the “Long-Term Investment Management Strategy (Surf Plan).” Under this strategy, through value investment and contrarian investment(Note) by focusing on the cyclicality of real estate prices, TOKYU REIT secures capital gains while replacing properties, aiming to build a portfolio that boasts lasting competitiveness and balance sheets that are strong against even difficult economic times. The objective of this approach is to accurately discern the ‘waves’ of prosperity and depression in real estate market conditions.

- Value

- An approach of investing into properties that are undervalued against the respective benchmarks. TOKYU REIT aims to secure high yield (total return) by acquiring properties that appear to be undervalued in terms of their appraisal values, NOI (net operating income) and other indicators.

- Contrary

- An approach of investing in the phase when prices are falling. TOKYU REIT aims to acquire properties when they are priced low and sell them when they are priced high, thereby recouping the investment.

TOKYU REIT focuses on office buildings, retail facilities, residences and complexes that include any one of these facilities. When a hotel is included in the above complex, it shall, in principle, meet the following criteria.

- A lease agreement which can reduce business/operational risks of the hotel shall be concluded with the tenant of the hotel portion of the complex.

- The tenant of the hotel portion of the complex shall be Tokyu Corporation and its subsidiaries or shall possess operational skills equal to those of Tokyu Corporation and its subsidiaries.

- * Use of complexes that include office or retail properties include, but not limited to, hotel. When the use of a property is solely hotel, etc., TOKYU REIT shall not invest in the property.

- * TOKYU REIT may acquire ownership right of land with leasehold interest. The use of buildings on the land with leasehold interest shall be only office buildings, retail facilities, residences and complexes that include any one of these facilities.

TOKYU REIT invests primarily in Central Tokyo, and the Tokyu Areas. It does not invest outside of the Tokyo Metropolitan Area.

| Area | |||

|---|---|---|---|

| Central Tokyo | Five Central Tokyo Wards | Chiyoda, Chuo, Minato, Shinjuku and Shibuya wards | More than 85% |

| Other major commercial and retail districts of Tokyo | The areas surrounding Ikebukuro, Koraku, Ueno and other areas | ||

| Tokyu Areas | Tokyu Rail network hub | Shibuya Ward | |

| Other Tokyu rail network areas | Tokyo: Shinagawa, Meguro, Setagaya and Ota wards : Machida City Yokohama, Kanagawa, Prefecture : Kohoku, Kanagawa, Naka, Nishi, Midori, Aoba and Tsuzuki wards Kawasaki, Kanagawa Prefecture : Nakahara, Takatsu and Miyamae wards Yamato, Kanagawa Prefecture |

||

| Other | Other districts in the Tokyo Metropolitan Area, including Kanagawa, Saitama and Chiba prefectures (excluding the separately mentioned areas above) | Less than 15% | |

TOKYU REIT intends to invest primarily in Office properties, retail properties, and complexes that include office or retail properties in Central Tokyo, and the Tokyu Areas.TOKYU REIT believes these areas present high growth potential as a result of the following characteristics: (i) a growing population and a steady increase in the number of households, (ii) a high average income level, and (iii) an increase in the number of passengers using the Tokyu rail lines. In addition, TOKYU REIT believes Shibuya ward, which is the hub of the Tokyu rail network, presents a relatively favorable area for investment due to the relatively low office property vacancy rates in Shibuya ward.

| Office buildings | Retail facilities | Residences | |

|---|---|---|---|

| (A)Location | With respect to the acquisition of office properties, TOKYU REIT will assess an area's concentration of office facilities, local rental market conditions, the amount of floor space and the proximity of the property to the nearest station. TOKYU REIT generally only considers office properties that are within seven minutes' walking distance from a station, or within ten minutes' walking distance for properties with special characteristics(Note 1). | With respect to the acquisition of retail properties, TOKYU REIT will from time to time conduct a market evaluation to determine the appropriateness of the areas in which TOKYU REIT invests. This evaluation gives attention to such factors as the concentration of consumer population and movement, the number of households in the areas and their average income, growth potential of the area, current competition conditions, possible competition from future developments and compatibility with tenants. |

With respect to the acquisition of residences, TOKYU REIT will comprehensively assess local rental market conditions, the proximity of the property to the nearest station, property characteristics, etc. TOKYU REIT generally only considers properties that are within 10 minutes' walking distance from a station, or within 15 minutes' walking distance for properties with special characteristics (Note 1). |

| (B)Property Size (Note 2)(Note3) |

Appropriate sizes shall be determined taking into account individual locational characteristics and tenant business type for each property. | TOKYU REIT will determine the appropriate size of each retail property with consideration of each location, market size and of the area and standard floor space, as well as the growth potential of the area. | TOKYU REIT will determine the appropriate size of each property with consideration of location, attributes of tenants or user groups, liquidity in the real estate market, economic performance of investment in terms of management, etc. |

| (C)Fixtures (Note 2)(Note3) |

TOKYU REIT installs fixtures that are above standard with respect to floors, ceilings, facilities in common areas, electricity capacity and air conditioning systems. | TOKYU REIT considers retail property individually, giving general consideration to the versatility of such property the ability to alter the designed use of such property and the accessibility by retail consumers. | TOKYU REIT installs fixtures that are above standard in the relevant locality, with respect to fixtures in common areas and exclusive areas. |

| (D)Investment Size, Investment Amount and Acquisition Price (Note3) |

|||

| I)Minimum Amount | Minimum investment amount per property shall be 4 billion yen, in principle. However, minimum investment amount per property for properties located in Tokyu Areas shall be 1 billion yen and minimum investment amount per property for properties located in Central Tokyo (excluding Shibuya ward) shall be 2 billion yen. As for land with leasehold interest, minimum investment amount per property shall be 1 billion yen regardless of the location being in the investment target areas. However, the above shall not apply to investment targets that are regarded as ancillaries of investment properties. |

||

| II)Limitation of Acquisition Price | Upon making investments in real estate, etc., the acquisition price is judged individually taking into account the appraisal value. However, it may exceed the appraisal value depending on the property features. Specific management shall be stipulated in the detailed regulations in the management guideline of TOKYU REIT (the “Detailed Regulations”). However, acquisitions from related parties and warehousing SPCs (entities established based on the intention of Tokyu Corporation whose purpose is solely to own Investment Properties) shall be made pursuant to the Rules on Related-Party Transactions. | ||

| (E)Earthquakes (Note 2)(Note3) |

TOKYU REIT invests only in (i) buildings that are in compliance with current earthquake regulatory standards, (ii) existing buildings that have been reinforced against earthquakes, or (iii) buildings that have a probable maximum loss, or PML, of less than 15%. | ||

| (F)Contractual Relationship | In principal, when acquiring a property subject to joint ownership, TOKYU REIT acquires more than 50% ownership of such property. Requirements for acquiring a property with co-ownership interest of less than 50% shall be stipulated in the Detailed Regulations. |

||

| (G)Tenants | Tenants shall be considered comprehensively by taking into account their creditworthiness, the terms and conditions of the lease agreement, substitutability, property competitiveness, etc. When a hotel is included in the complex that includes office, retail properties or residences, it shall, in principle, meet the following criteria. A lease agreement which can reduce business/operational risks of the hotel shall be concluded with the tenant of the hotel portion of the complex. The tenant of the hotel portion of the complex shall be Tokyu Corporation and its subsidiaries or anyone who possesses operational skills equal to those of Tokyu Corporation and its subsidiaries. |

||

| (H)Asset-Backed Securities | TOKYU REIT invests in asset-backed securities only if such securities contain an option to purchase the underlying assets at the time of maturity and are deemed to provide stable income. | ||

| (I)Properties Under Construction | TOKYU REIT shall, in principle, invest in properties that are actually generating or expected to generate rental income. For properties such as below, TOKYU REIT shall make investments in properties under construction after taking note of development risks. (1) Acquisition of a property being constructed by a third-party Acquisition shall be made when it is confirmed that the leasing risk, price fluctuation risk, etc. after completion will not have an excessive impact on the entire portfolio, provided that TOKYU REIT will not bear the risks of completing the construction and delivery. (2) Addition to a property already acquired An addition shall be constructed after analyzing development risks associated with the construction (risks of obtaining permits and approvals, completing the construction, leasing, price fluctuation, etc.) and confirming that those risks will not have an excessive impact on the entire portfolio, provided that such construction will contribute to enhancing the value of the existing property. |

||

| (J)Environmental Review | Prior to the acquisition of any property, TOKYU REIT investigates such property for toxic substances, soil contamination and other environmental hazards and evaluates any mid- to long-term effects on such property. | ||

(Note 1) The figures are calculated as it takes one minute for 80 meters based on fair competition rules concerning real estate indication.

(Note 2) When acquiring ownership right of land with leasehold interest, regulations on “B) Property size,” “C) Fixtures” and “E) Earthquakes” shall not apply.

(Note 3) From the viewpoints of maintenance of functions, securement of legality, maintenance/enhancement of asset value, etc., TOKYU REIT may acquire a property as an ancillary property of other investment property.

Furthermore, from the viewpoints of maintenance/enhancement of asset value, smoother/more efficient operations, etc., TOKYU REIT may additionally acquire sectional ownership, co-ownership interest or such of a property already owned; or acquire land and building or land in the neighboring areas of a property already owned. In such cases, regulations on “B) Property size,” “C) Fixtures” and “D) Investment size, investment amount and acquisition price” shall not apply. (When acquiring only the ownership of land (raw land) in the adjacent or neighboring areas of a property already owned, regulations on “E) Earthquakes” shall not apply either.

(Note 4) “LTV” refers to interest-bearing liabilities as a percentage of total amount of assets.

(Note 5) “DSCR” refers to net cash flow as a percentage of principal and interest liabilities of interest-bearing liabilities.

TOKYU REIT shall acquire properties that will contribute to the enhancement of asset value and the growth of profits from a medium- to long-term perspective, by carefully monitoring the trends of the real estate transaction market and implementing proper due diligence.

(a) Property information collection operations (Sourcing)

In addition to its own information sources, TOKYU REIT shall seek property information from a wide range and make an effort to collect highly reliable information.

(b) Property evaluation operations (Valuation)

Evaluation shall be conducted pursuant to the internal rules of the asset management company.

(c) Property assessment operations (Due diligence)

- Property assessment

Property assessment shall be conducted pursuant to the internal rules of the asset management company. - Outsourcing to experts

TOKYU REIT can outsource portions of investigation items to an expert when assessing properties. When selecting experts, a comprehensive evaluation shall be conducted in a fair manner by taking into consideration expertise, cost-benefit performance, independence, etc.

(d) Contract/delivery operations

Operations shall follow the internal rules of the asset management company. The payment/receipt for the purchase/sale and delivery of the property shall be made at the same time, and property registration application shall be filed on the delivery date.

TOKYU REIT shall aim to maximize a sales price by opting a sales means suitable for the characteristics of a property. Selection of a buyer shall be made based on its credibility of transactions such as fund procurement capability in addition to the sales price.