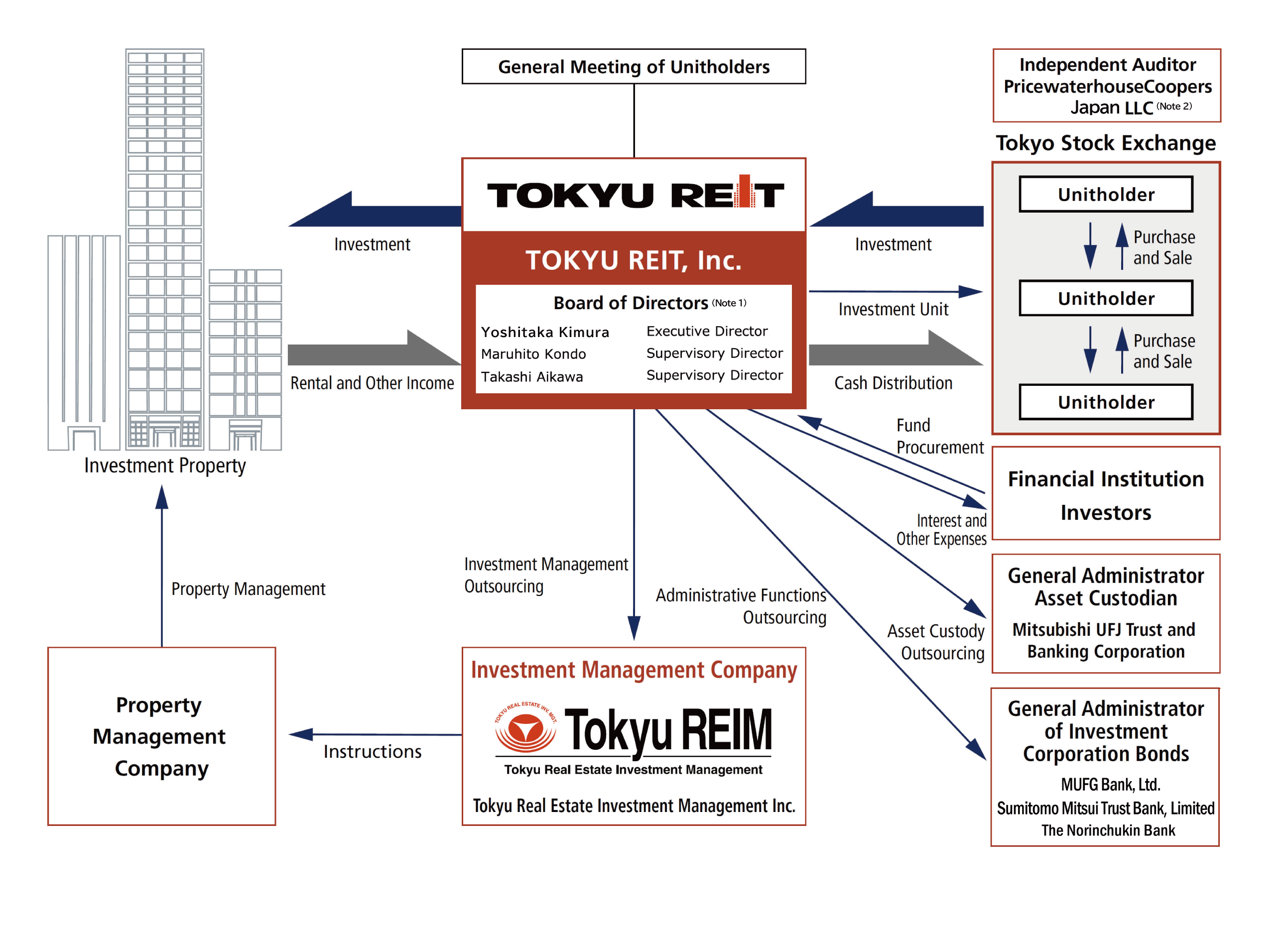

Structure and External Service Providers

(Note 1) In addition, appointments of Tatsumi Yamagami as a substitute executive director and Minako Matsumoto as a substitute supervisory director were approved at the General Meeting of Unitholders of TOKYU REIT held on April 21, 2023.

(Note 2) Changed its name from PricewaterhouseCoopers Aarata LLC on December 1, 2023.

TOKYU REIT, Inc. was incorporated to invest in real estate on June 20, 2003 under the Law Concerning Investment Trusts and Investment Corporations of Japan (Law No. 198 of 1952, as amended), or the Investment Trust Law. Such corporations are commonly referred to as Japanese Real Estate Investment Trusts, or J-REITs.

Tokyu Real Estate Investment Management Inc., or Tokyu REIM, incorporated on June 27, 2001, is TOKYU REIT's investment manager. Tokyu REIM is owned 100% by Tokyu Corporation. Tokyu REIM is registered under the Financial Instruments and Exchange Law as a financial instruments firm and serves as investment manager for J-REITs under Investment Trust Law.

Tokyu REIM provides the following services to TOKYU REIT:

- Management of TOKYU REIT's properties.

- Management of TOKYU REIT's finances.

- Reporting to TOKYU REIT.

- Other services that reasonably relate to the foregoing services.

Mitsubishi UFJ Trust and Banking Corporation, a Japanese trust and banking subsidiary of Mitsubishi UFJ Financial Group, Inc., is the asset custodian and general administrator of TOKYU REIT's assets. Mitsubishi UFJ Trust and Banking Corporation and TOKYU REIT are parties to an asset custody agreement and a general administration agreement.

Pursuant to these agreements, Mitsubishi UFJ Trust and Banking Corporation provides the following services to TOKYU REIT:

- Custody of TOKYU REIT's assets.

- Transfer agency for TOKYU REIT's units.

- Administration of unitholders' meetings and directors' meetings.

- Administration of distributions to TOKYU REIT's unitholders.

- Administration of issuance of TOKYU REIT's unit certificates.

- Administration of accounting matters.

- Receiving certain requests on TOKYU REIT's behalf from our unitholders.

- Preparation of financial documents.

- Administration of tax payments.

On the basis of agreement, Mitsubishi UFJ Trust and Banking Corporation also provides service of administration of the accounts.

As a general administrator as stipulated in the Investment Trust Law (administration of investment corporation bonds in Article 117-2, 3 & 6 of the Act on Investment Trusts and Investment Corporations), MUFG Bank, Ltd. conducts the following administrative work based on the agreement.

- Preparation and keeping of the investment corporation bonds registry and other affairs related to the investment corporation bonds registry.

- Issuance of investment corporation bonds.

- Payment of interest or redemption money to the creditors of investment corporations.

- Requests related to the exercise of the rights of the creditors of investment corporations and other affairs related to the acceptance of offers from the creditors of investment corporations.

As a general administrator as stipulated in the Investment Trust Law (administration of investment corporation bonds in Article 117-2, 3 & 6 of the Act on Investment Trusts and Investment Corporations), Sumitomo Mitsui Trust Bank, Limited conducts the following administrative work based on the agreement.

- Preparation and keeping of the investment corporation bonds registry and other affairs related to the investment corporation bonds registry.

- Issuance of investment corporation bonds.

- Payment of interest or redemption money to the creditors of investment corporations.

- Requests related to the exercise of the rights of the creditors of investment corporations and other affairs related to the acceptance of offers from the creditors of investment corporations.

As a general administrator as stipulated in the Investment Trust Law (administration of investment corporation bonds in Article 117-2, 3 & 6 of the Act on Investment Trusts and Investment Corporations), The Norinchukin Bank conducts the following administrative work based on the agreement.

- Preparation and keeping of the investment corporation bonds registry and other affairs related to the investment corporation bonds registry.

- Issuance of investment corporation bonds.

- Payment of interest or redemption money to the creditors of investment corporations.

- Requests related to the exercise of the rights of the creditors of investment corporations and other affairs related to the acceptance of offers from the creditors of investment corporations.

TOKYU REIT selects the property managers responsible for the day-to-day operation and management of the properties in which TOKYU REIT invests.