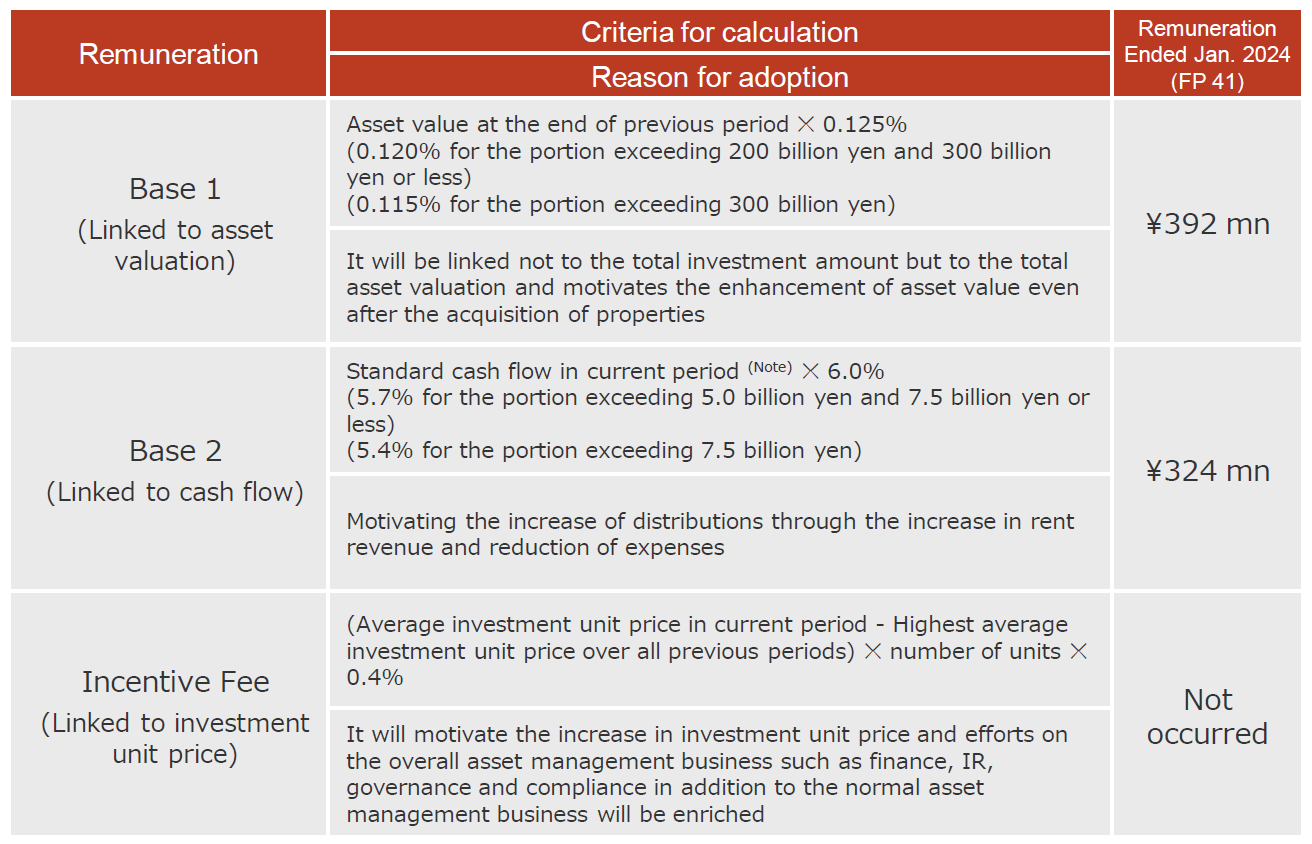

Investment Management Fee

Investment management fee structure

※Investment management fee structure linked to three performance indices aimed to balance conflicts of interest by “being in the same boat as unitholders.”

(Note) Standard cash flow here shall be the amount derived by subtracting an amount equivalent to 50% each of profit or loss from the sale of specified assets and profit or loss from the valuation of specified assets from the net income before income taxes, plus depreciation and amortization of deferred assets.

※ The above fees are all booked as expenses. TOKYU REIT does not adopt an acquisition incentive fee, which is capitalized on the balance sheet.

※ Apart from the above, TOKYU REIT pays predetermined fees, etc. to an asset custodian, general administrators, property management companies and an independent auditor, among others.